Where/how do I input the Lease Term in Occupier?

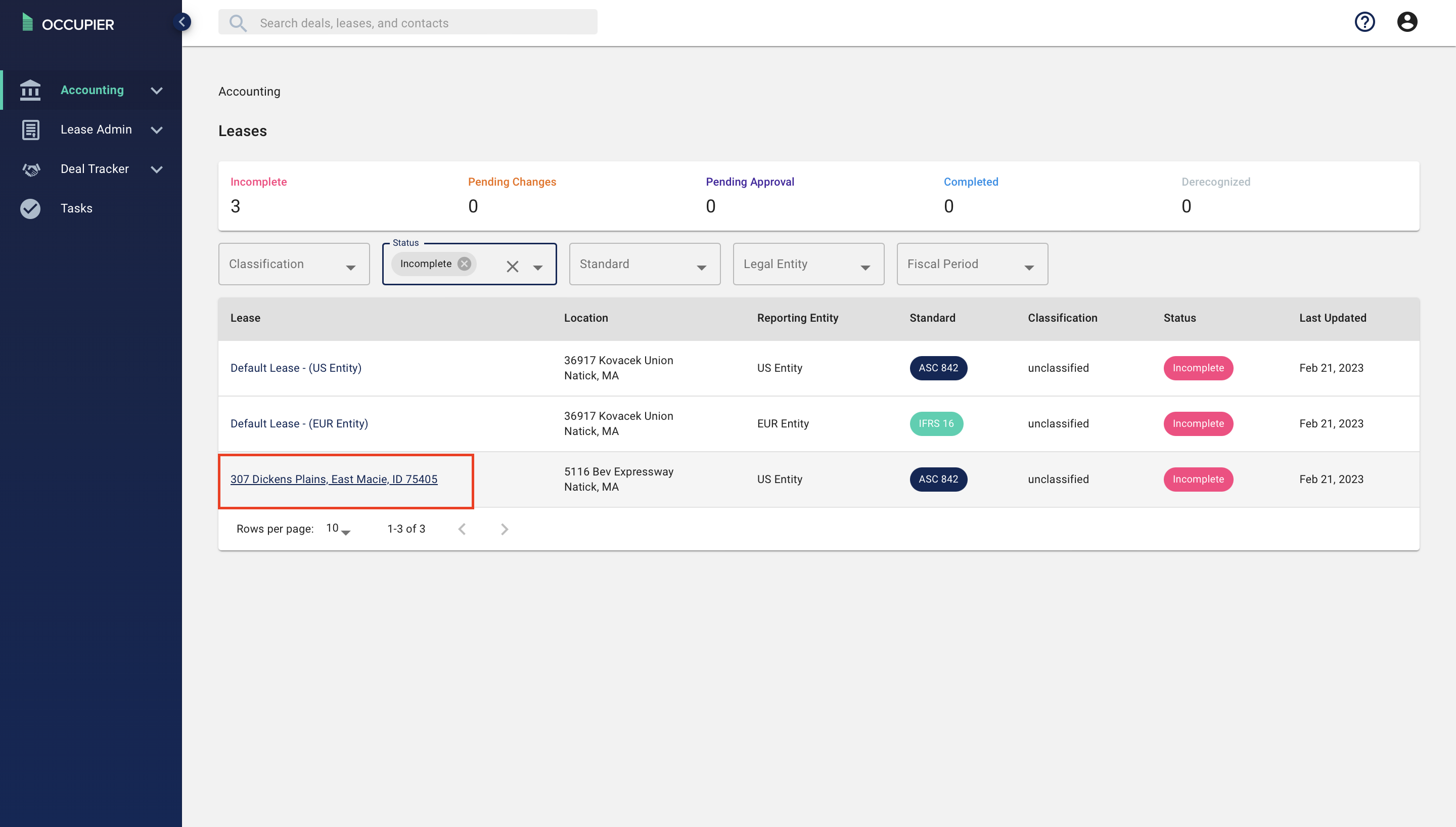

Step 1- Select the "Incomplete" lease which you wish to complete from the Lease Status page.

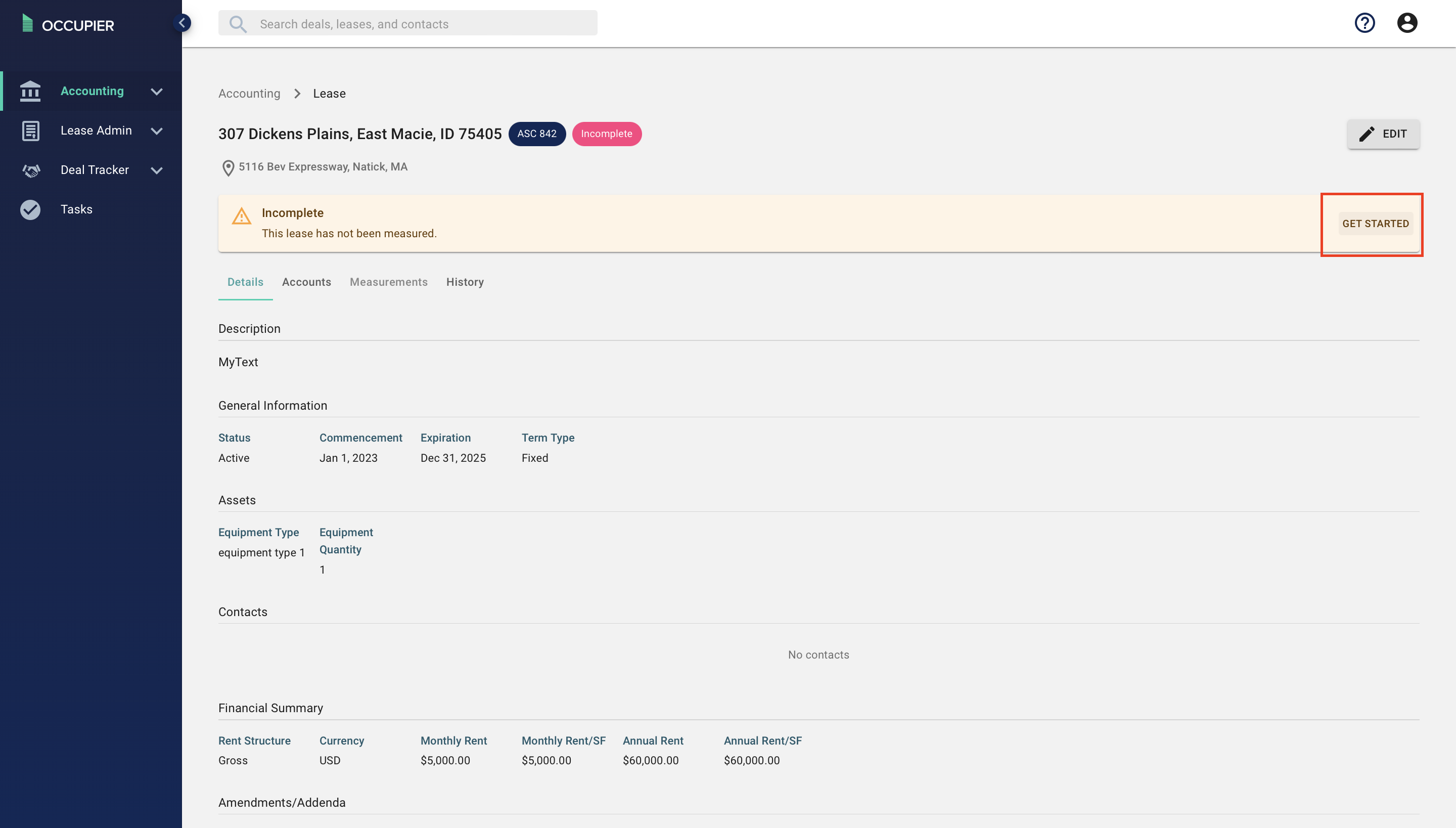

Step 2- Select "Get Started" on the Lease tab.

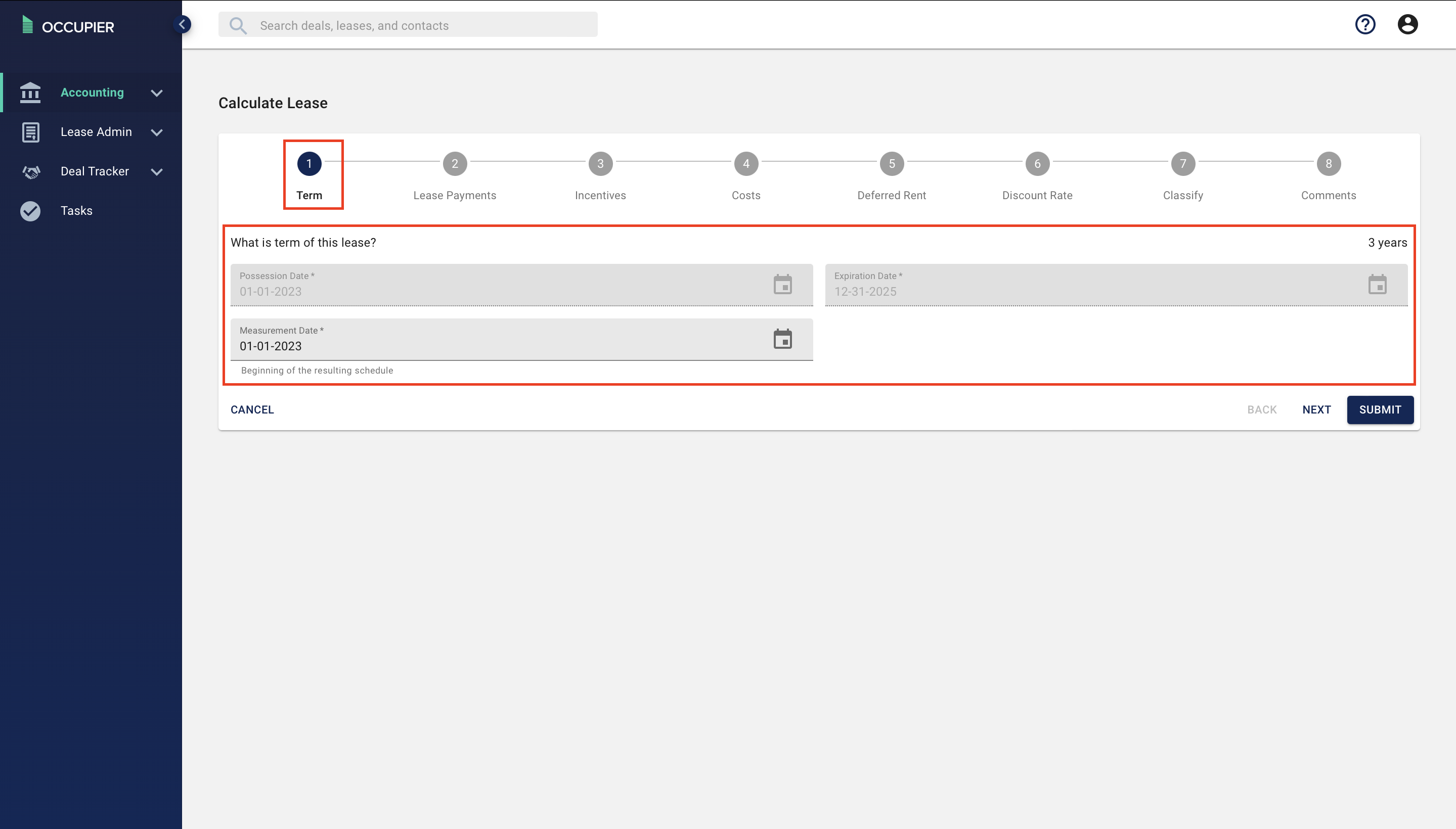

Step 3- Input the Lease Term details.

Possession Date: Date possession is gained of underlying asset. This is determined within the Lease Administration module. This would be considered the "Lease Commencement" date per ASC 842/IFRS 16.

Expiration Date: Date possession expires. This is determined within the Lease Administration module.

Measurement Date: This date is automatically calculated by Occupier. This date should be the later of the Adoption Date or the Possession Date. For instance, in the example below, if this company adopted ASC 842 on 1/1/2022 and gained possession to this lease on 4/28/22, the measurement date would be 4/28/22. This would be the first date of the amortization schedule and journal entries.

Prorated Fiscal Periods: This screen will display if a pro-rated period is detected (lease commences or terminates in middle of month). The software will automatically calculate the % of possession to pro-rate expenses for the first and last month. If you would like to override this calculation, you can by entering in the updated % amount.

Step 4- Hit the blue "Submit" button and go to the next step.