What is Lease Classification?

Under IFRS 16 there is no classification of leases. All leases (except short-term leases) are treated the same (as a Finance lease).

A lease can be classified as short-term if the lease term is less than twelve months and the practical expedient for short-term leases has been elected. If this policy election is elected, then lease payments are expensed through the Income Statement the same way they would have been under ASC 840 (the legacy lease accounting standard).

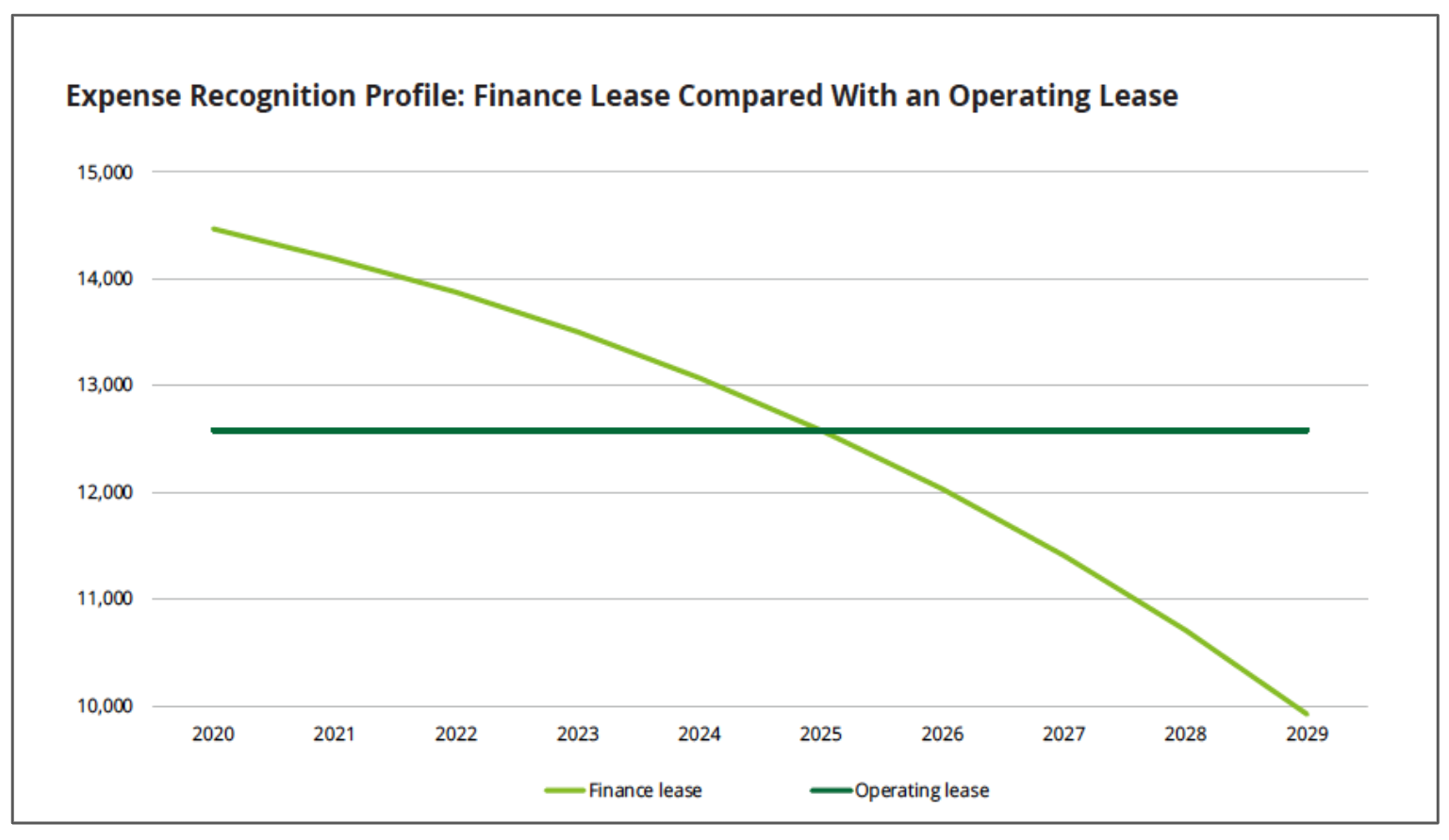

Appropriately classifying your leases is crucial as it drives the subsequent accounting of the lease under ASC 842. Therefore, appropriately classifying your lease is the first step to accurate financial reporting. As you can see in the chart below, the classification will impact the subsequent expense recognition. For operating leases, the income statement impact with my consistent period over period through the lease. On the other hand, a finance lease's expense profile will be front loaded.