What is included as a Lease Payment?

The lease payments include fixed payments, less any incentives received by the lessee from the lessor payable at the commencement date, plus variable payments based on a rate or index. Variable payments not based on a rate or index, such as those based on throughput or usage, are not included in determination of the initial lease liability and will be recognized as incurred- such costs are often referred to as "non-lease components."

A common example of a variable payment based on a rate or index would be a lease payment that is driven by CPI.

A few common examples of a variable payments not based on a rate or index would be CAM charges, utility charges, internet and rent based on percentage of sales.

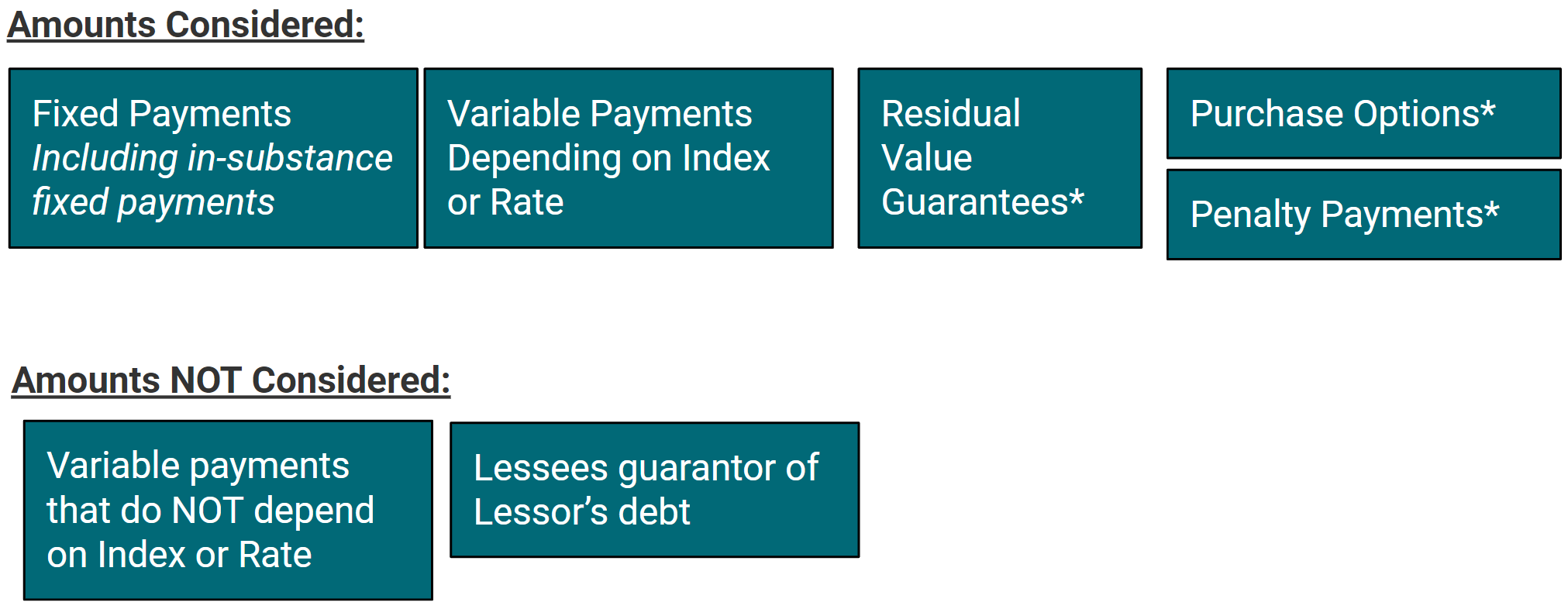

In summary, these are the types of payments that would and would not be considered a Lease Payment:

*These types of payments would only be included if they were reasonably certain to be incurred as of the lease measurement date