How do I add my Chart of Accounts into Occupier?

You can manually add or upload your chart of accounts information into Occupier. To upload your accounts, refer to this article (https://help.occupier.com/knowledge/how-do-i-add-my-chart-of-accounts-into-occupier)

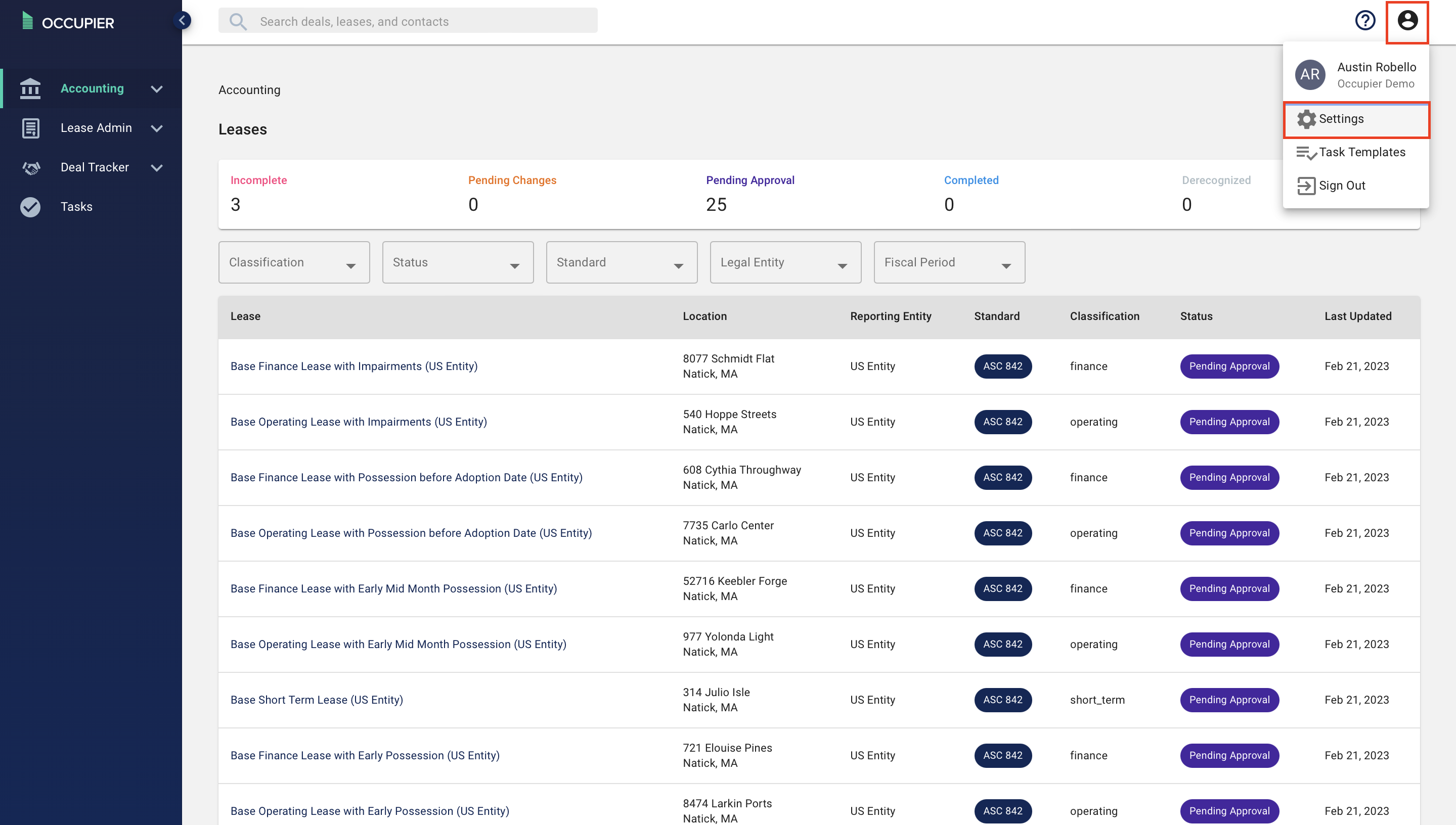

Step 1: Open the Lease Accounting module.

Step 2: Navigate to Account Settings (on the top right-hand corner).

![]()

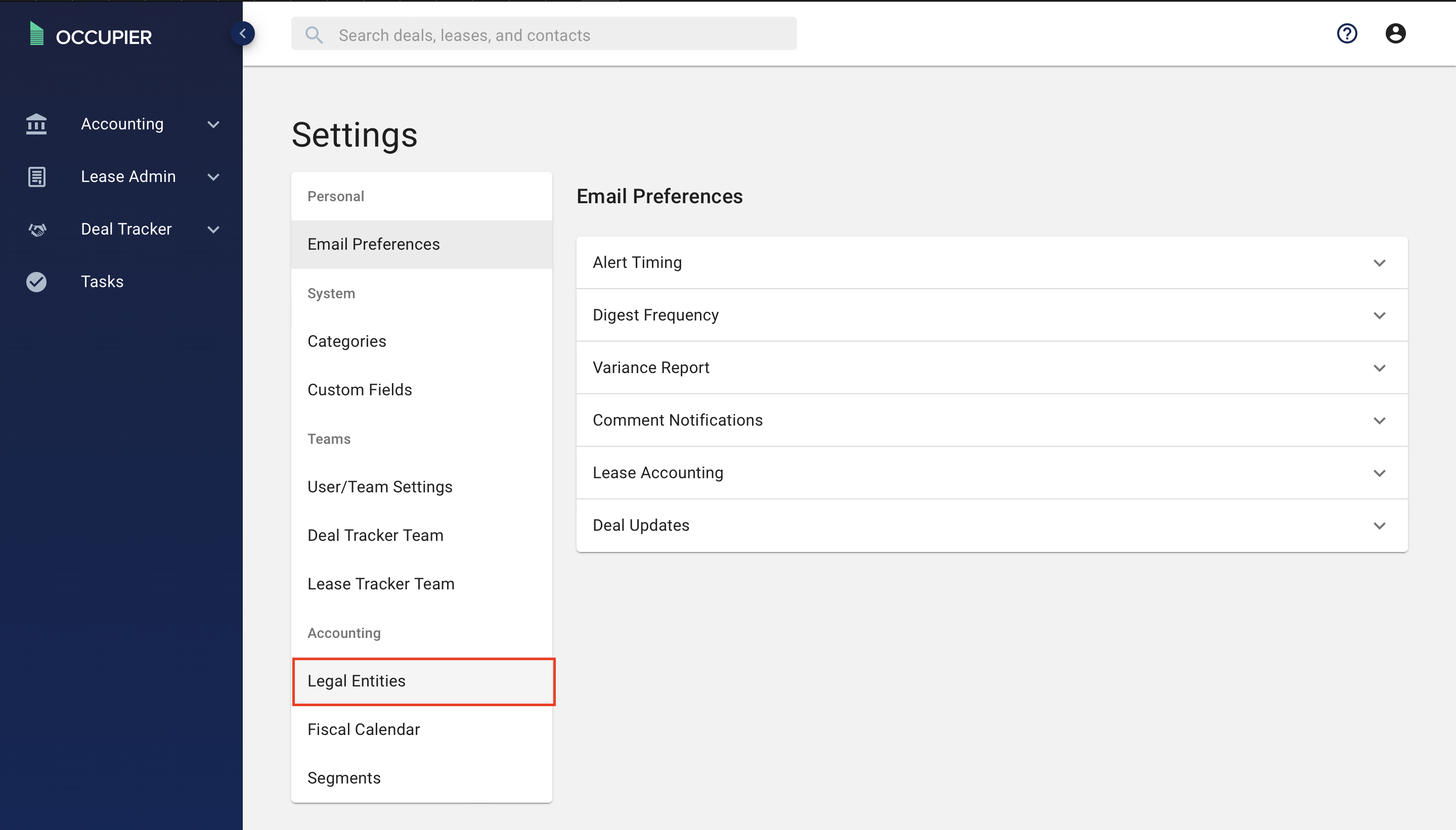

Step 3: Click on Legal Entities.

Step 4: Once in the Legal Entities screen select "Ledger Accounts" once you have navigated to the Legal Entity you want to populate the Chart of Accounts for.

If you would like, you can also upload your Chart of Accounts into Occupier by following these steps outlined here.

*Note- any Legal Entity that does not have accounts setup will show the "Accounts Required" prompt. This is an indication that you still need to add accounts for this Legal Entity. If a legal entity is "Consolidated with Parent", the chart of accounts mapped to this entity will be the Ledger Accounts used by the Parent.![]()

Step 5: To add a Ledger Account select "Add Account." Enter "Account Name" , "Account Code.", and select which "Account Type"![]()

Income Statement (also known as the Profit & Loss Statement) reflects a company's performance over a specific period.

Balance Sheet shows the company’s financial position at a specific point in time, detailing assets, liabilities, and shareholders' equity

For more info on Account type, please click here.

How do you know what accounts I need to create for my Lease Accounting balances? Below is a list of common accounts used by our customers and when you would want to use them:

Accounts that could be applicable for ALL leases regardless of portfolio

ROU Asset- This will be the account(s) where your Right of Use (ROU) Assets will reside. This is a Balance Sheet account and will be required for ALL customers regardless of lease portfolio.

Note- Although it is not required- customers sometimes prefer to create a few different ROU Asset accounts to differentiate between their types of leased assets (ex: ROU Asset- Building, ROU Asset- Vehicles, etc.).

Cash- This will be the account where your payments get applied. This will ultimately reduce your lease liability every month by the amount of the lease payment. This configuration is required for ALL customers regardless of lease portfolio.

Note- Most customers have an AP process where the cash payment is already applied outside of Occupier. Due to this there is a best practice that is normally used within Occupier. This best practice involves using a suspense/clearing account for the cash transactions in Occupier. During the AP application process your AP Coordinator would then Debit the same Suspense/Clearing account while Crediting Cash/AP. This will ensure that when Occupier's entries are posted at the end of the month that the Suspense/Clearing account clears to $0 and that your cash application process remains untouched.

Deferred Rent- This will be the account where your Deferred Rent is currently housed on your Balance Sheet, as at your transition date. This amount will be re-classified into the ROU Asset upon transition to ASC 842/IFRS 16. Not all companies will have Deferred Rent when they transition to IFRS 16 or ASC 842.

Note- If your organization does not have any Deferred Rent then you can map any account to this configuration. This is where customers will sometimes create a "Not Applicable" account and map it to configurations that do not apply to their leasing portfolio.

Incentives- This will be the account where your Lease Incentives are currently housed on your Balance Sheet, as at your transition date. This amount will be re-classified into the ROU Asset upon transition to ASC 842/IFRS 16. Not all companies will have Incentives when they transition to IFRS 16 or ASC 842.

Note- If your organization does not have any Lease Incentives then you can map any account to this configuration. This is where customers will sometimes create a "Not Applicable" account and map it to configurations to do not apply to their leasing portfolio.

Initial Direct Costs- This will be the account where your Initial Direct Costs will be recorded (if any).

Note- If your organization does not have any Initial Direct Costs then you can map any account to this configuration. This is where customers will sometimes create a "Not Applicable" account and map it to configurations that do not apply to their leasing portfolio.

Prepaid Rent- This will be the account where Prepaid Rent will be re-classified into the ROU Asset (if any exists) at the time a lease is executed and/or transitioned to ASC 842/IFRS 16.

Note- If your organization does not have any Prepaid Rent then you can map any account to this configuration. This is where customers will sometimes create a "Not Applicable" account and map it to configurations that do not apply to their leasing portfolio.

Short-term Rent Expense- This is where an organization will code rent expense on short-term leases. This is normally differentiated from rent expense on long-term leases (leases within scope of ASC 842/IFRS 16) on the Statement of Profit and Loss.

Note- If your organization does not have any short-term leases then you can map any account to this configuration. This is where customers will sometimes create a "Not Applicable" account and map it to configurations that do not apply to their leasing portfolio.

Current Liability- This is the account where the current lease liability will be configured. This is required for ALL customers regardless of lease portfolio.

Non-current Liability- This is the account where the non-current lease liability will be configured. This is required for ALL customers regardless of lease portfolio.

Gain/(Loss) on FX- This is where an organizations Gain/(Loss) on FX will be recorded.

Note- If your organization does not have any leases denominated in foreign currency then you can map any account to this configuration. This is where customers will sometimes create a "Not Applicable" account and map it to configurations that do not apply to their leasing portfolio.

Gain/(Loss) on Termination- This is where organizations will record their Gain/(Loss) on terminating a leasing arrangement. This is recommended for ALL customers regardless of lease portfolio as all customers may eventually want to terminate a lease.

Accounts that applicable for ONLY operating leases

Lease Expense- This will be the account where customers configure their lease expense. This is where lease expense will be coded for all operating leases. This configuration is required for ALL customers who have operating leases in their portfolio.

Note- If your organization does not have any operating leases then you can map any account to this configuration. This is where customers will sometimes create a "Not Applicable" account and map it to configurations that do not apply to their leasing portfolio.

Accounts that applicable for ONLY finance (and/or IFRS 16) leases

Interest Expense- This will be where interest expense will be recorded. Interest expense is ONLY recorded on finance leases (not on operating leases). This configuration is required for ALL customers who have finance leases in their portfolio.

Note- If your organization does not have any finance leases then you can map any account to this configuration. This is where customers will sometimes create a "Not Applicable" account and map it to configurations that do not apply to their leasing portfolio.

Asset Depreciation Expense- This will be where depreciation expense will be recorded for finance leases. Depreciation expense is ONLY recorded on finance leases (not on operating leases). This configuration is required for ALL customers who have finance leases in their portfolio.

Note- If your organization does not have any finance leases then you can map any account to this configuration. This is where customers will sometimes create a "Not Applicable" account and map it to configurations that do not apply to their leasing portfolio.

Asset Reduction- This is the account configuration that will reduce the ROU Asset every month for finance leases. Customers will typically either configure the ROU Asset or ROU Asset- Accumulated Depreciation accounts. This configuration is required for ALL customers who have finance leases in their portfolio.

Note- If your organization does not have any finance leases then you can map any account to this configuration. This is where customers will sometimes create a "Not Applicable" account and map it to configurations that do not apply to their leasing portfolio.

It is important to match this with your internal Chart of Accounts as this is what will drive the journal entries once the lease is entered into Occupier.